Automotive industry shows signs of recovery, a positive for the industry’s 2021 ad spending

The major automotive companies reported positive year-end sales figures yesterday, a potentially good sign for the industry’s ad spending in 2021. In Q4 2020, General Motors posted a 4.8% increase in sales year over year (YoY), while Toyota posted a 9.4% gain. Hyundai announced a 2% YoY gain in December, but saw an overall 2% decline in Q4 sales. And although Nissan posted a 19.3% decline, that was still better than analyst expectations. But despite these quarterly gains, annual US auto sales overall still declined by as much as 4.7% in 2020, according to Bloomberg’s calculations of the average of five market research firms’ estimates. However, the auto companies’ relatively stronger finishes—driven in part by pent-up demand and a recovering economy—could suggest a strong 2021 is on the way.

In H1 2020, there was a sharp contraction in the auto industry’s ad spending, followed by growth in H2. Automotive companies made immediate cuts to their advertising budgets in March at the onset of the pandemic, and the industry’s TV ad spend for that month fell 30% YoY, followed by a staggering 71% YoY decline in April, according to data from iSpot.tv. But by the end of the summer, the return of football—a major destination for automotive ads—and the lifting of stay-at-home orders in some parts of the country sparked a return to advertising. By November, automotive brands spent an estimated $550.9 million on TV ads, a 4.4% YoY increase, according to iSpot.tv.

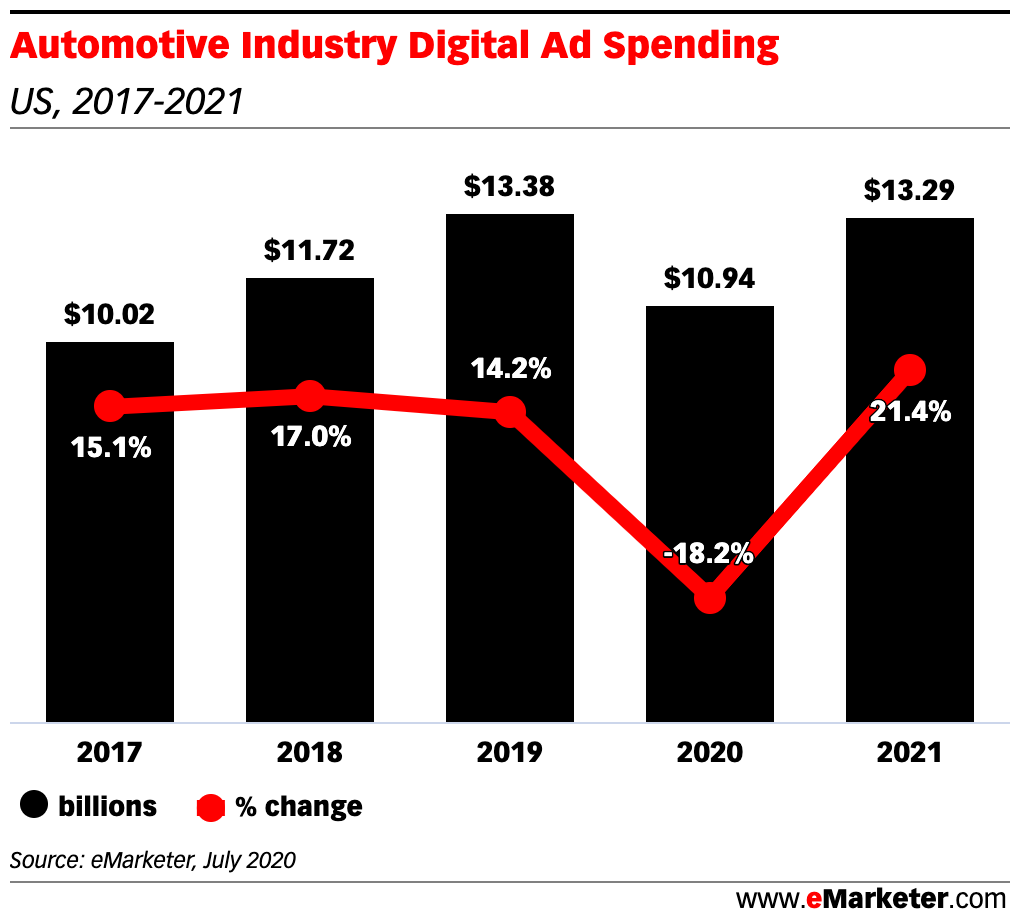

We expect a substantial rebound in digital advertising from automotive companies, assuming that the industry maintains this momentum throughout 2021. In the US, the arrival of stimulus checks, record-low interest rates, and vaccination rollouts could mean the automotive industry will receive a lift to its sales this year. Though we don’t track the industry’s TV ad spend, our estimates show that automotive digital ad spending will grow 21.4% in 2021 to $13.29 billion, slightly below its pre-pandemic peak. However, this rebound is still dependent on the persistence of the pandemic in the US and whether the industry can avoid any major supply chain issues that could limit inventory, such as the recent shortage in semiconductor chips.

Article Published on eMarketer by Daniel Carnahan on January 5, 2021