US Automotive Digital Ad Spending 2020

Executive Summary

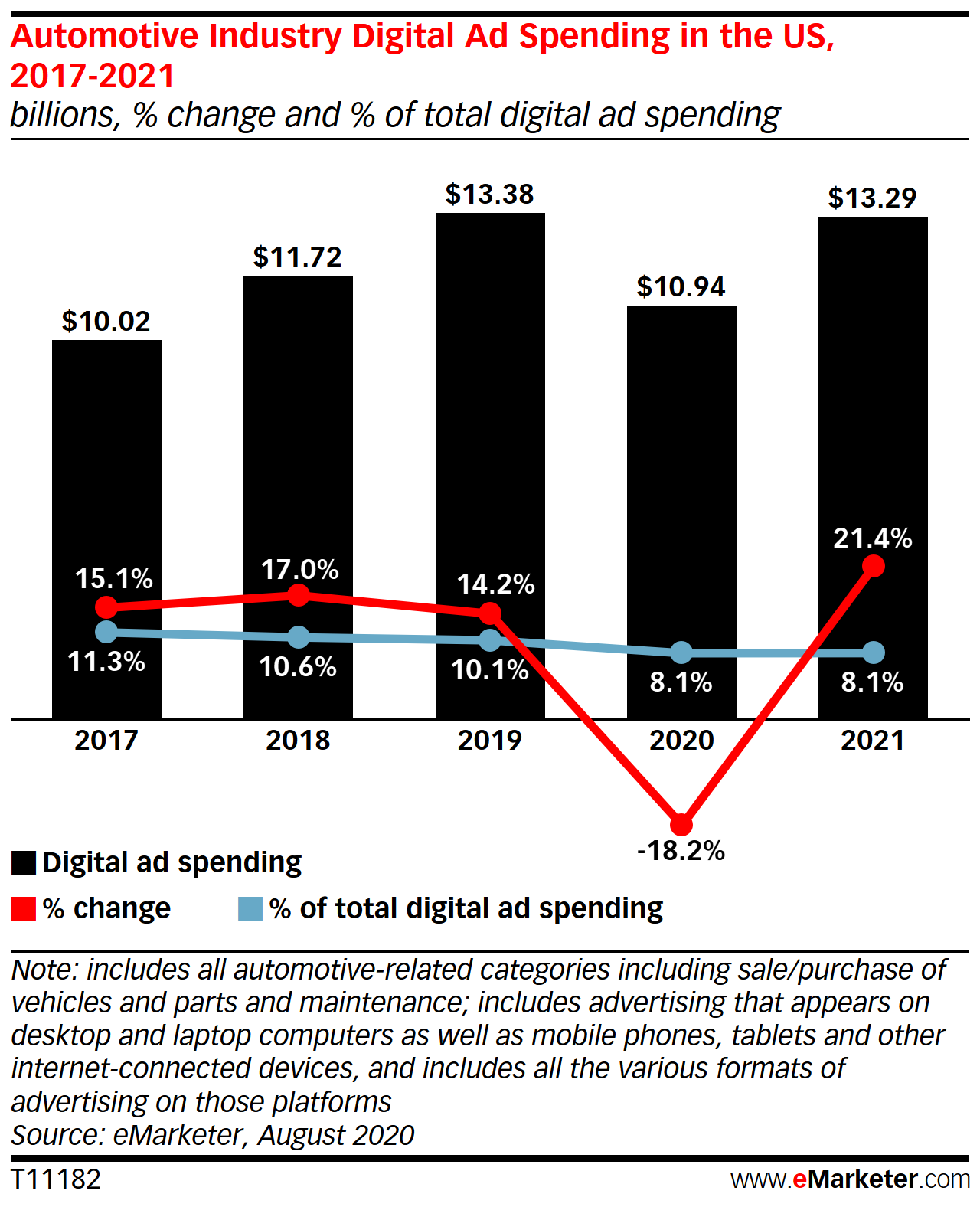

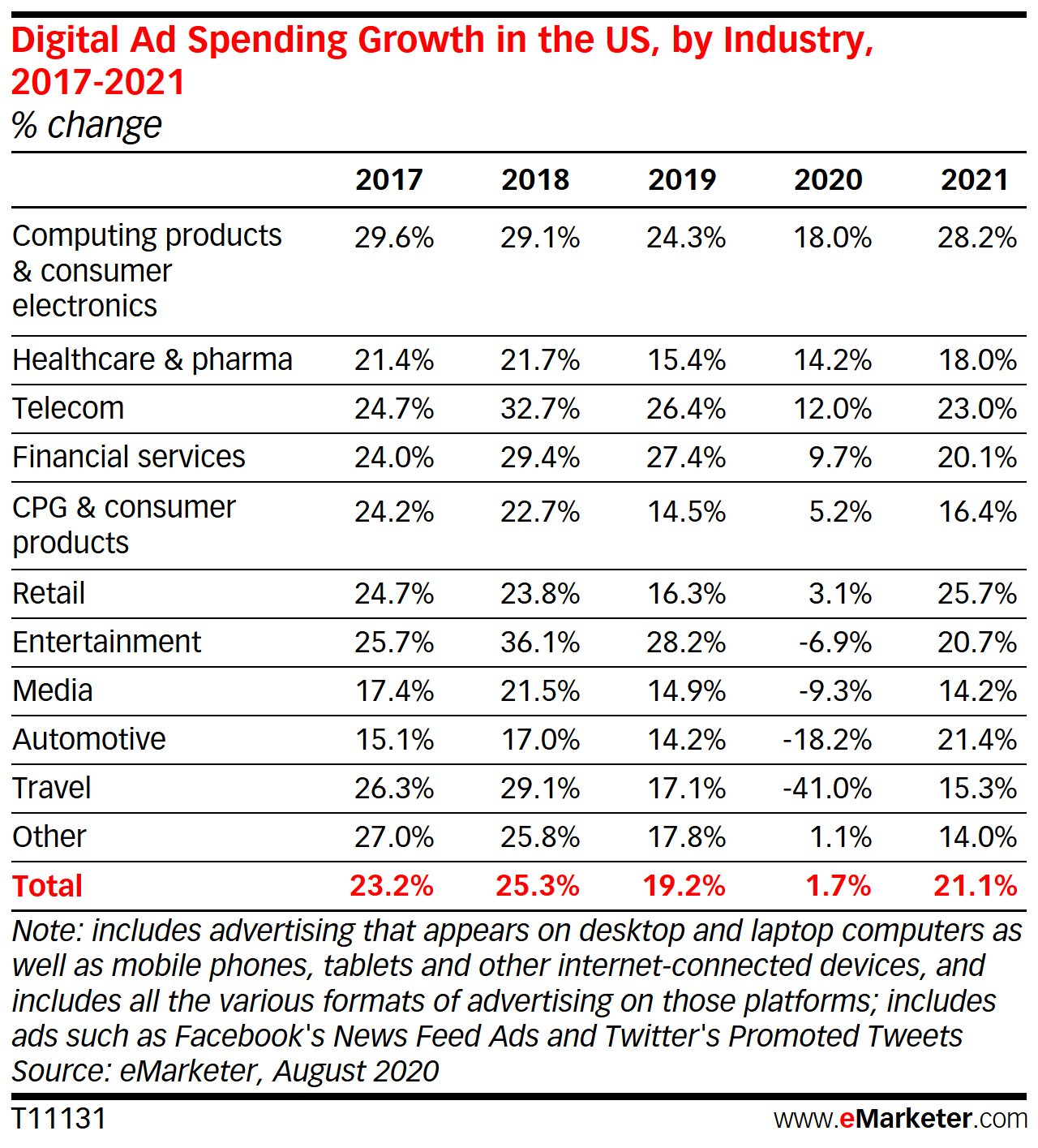

Digital ad spending in the US automotive industry will decrease by 18.2% this year to $10.94 billion. This will be the largest reduction in digital ad spend by an industry after travel, where spend will contract by 41.0%. Historically, automotive spending has been fairly even across search, video, and nonvideo display ads. But in 2020, search will take a back seat as auto advertisers focus less on performance marketing amid the coronavirus pandemic.

Why will automotive digital ad spending contract in 2020?

During the onset of the pandemic, car shoppers delayed their purchases, while manufacturing plants and dealerships closed or operated at limited capacity.

When will that spending recover?

This depends largely on when the pandemic subsides and how quickly the economy recovers. The recent rise in used car sales indicates a pent-up demand for car purchases. We expect auto digital ad spend will grow 21.4% in 2021 to $13.29 billion, slightly below its pre-pandemic peak.

How will the contraction affect ad spending by format?

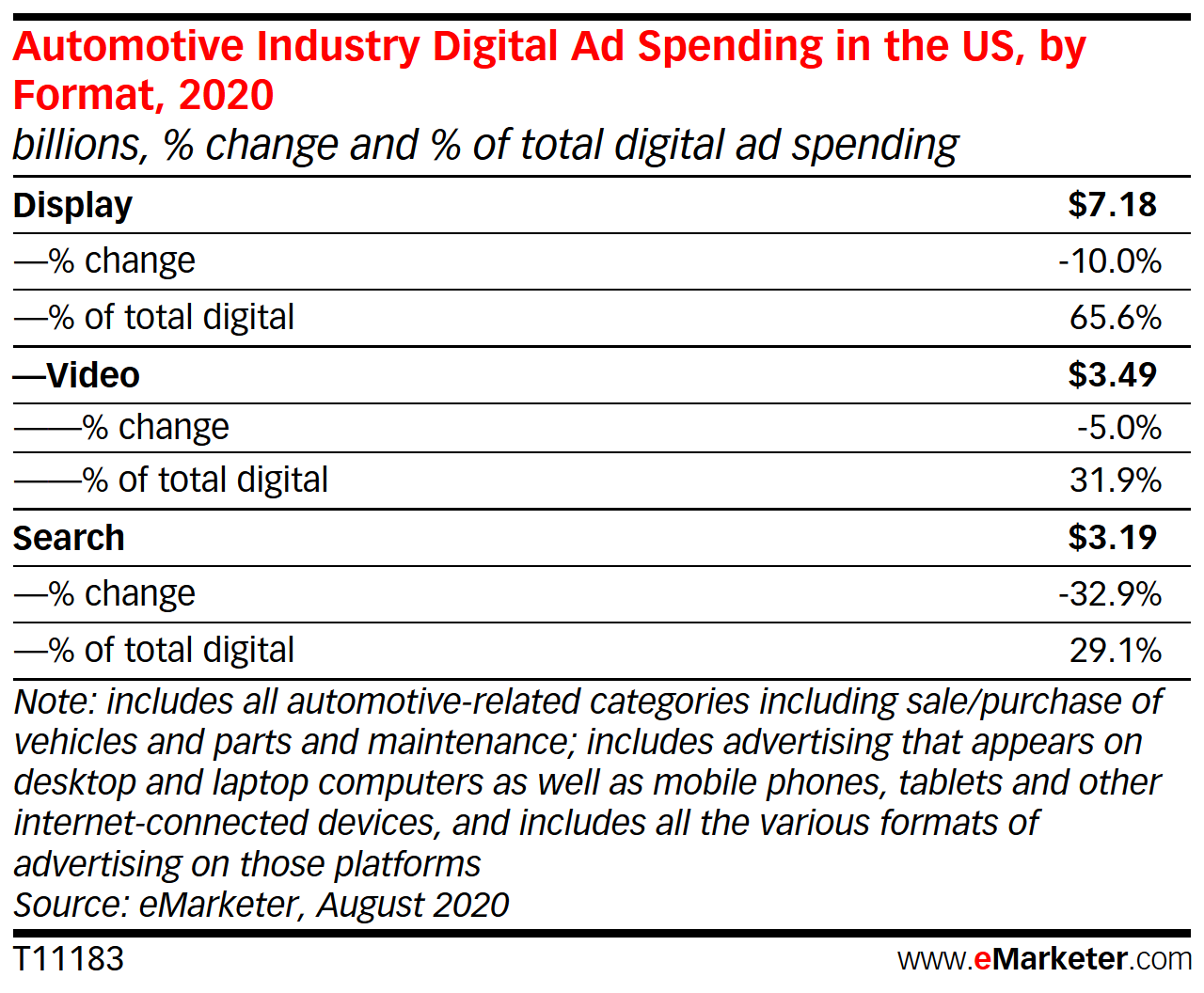

Auto advertisers will reduce spending on search by 32.9%, display by 10.0%, and video (a subset of display) by 5.0%. This reflects how advertisers are focusing on brand marketing over direct-response during the pandemic.

What share of total US digital ad spending will auto have?

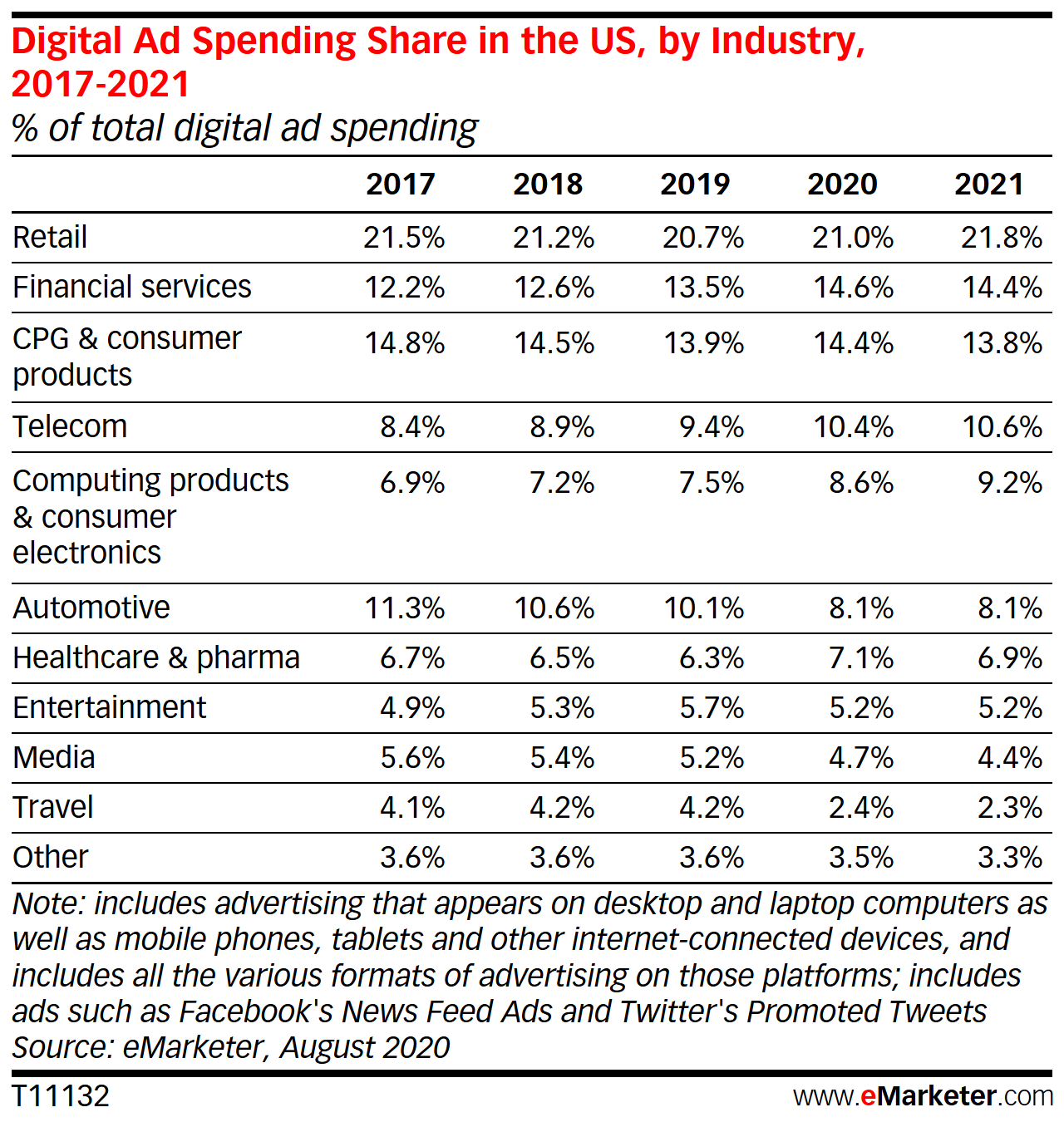

We anticipate that auto will make up 8.1% of total US digital ad spend in 2020, down from 10.1% in 2019. Its share has trended downward since we began tracking the vertical: from 12.1% in 2016, to 11.3% in 2017, to 10.6% in 2018.

WHAT’S IN THIS REPORT? This report details our annual forecast of US automotive digital ad spending. It includes a comprehensive overview of total digital ad spending, as well as estimates by channel, device, and format and the pandemic’s impact on these figures.

KEY STAT: Digital ad spending in the US automotive industry will fall 18.2% this year to $10.94 billion.

Behind the Numbers

We define automotive advertising to cover all automotive-related categories, including sales and purchases of vehicles, as well as parts and maintenance.

Our US digital ad spending by industry estimates are based on an analysis of 386 quantitative and qualitative data points from 32 sources (such as research firms, government agencies, media firms, and public companies), plus 125 interviews with top executives at publishers, ad buyers, and agencies. Data is weighted based on methodology and soundness. Each of our forecasts fits within the larger matrix of all our forecasts, with the same assumptions and general framework used to project figures in a variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends, and economic changes. Our industry ad spending estimates are updated yearly and are based on eMarketer’s estimate of total US digital ad spending, which was most recently updated in Q2 2020 and factors in the effects of the coronavirus pandemic.

Automotive Digital Ad Spending Outlook

The automotive industry had already been working under constrained ad budgets, as tariffs, emission standards, and macroeconomic instability have raised manufacturing costs and lowered profit margins for several years. Then, in April 2020, the coronavirus pandemic caused US auto sales to hit a 30-year low. With dealerships closed and consumers putting off big purchases, the automotive industry drastically reduced ad spending. Some auto advertisers have since ramped up their digital spending—and Q4 could make up for some of the losses seen in Q2—but on the whole, auto digital ad spending will contract in 2020. We expect the US automotive industry will spend $10.94 billion on digital advertising this year, down 18.2% from 2019.

Automotive digital ad spending has grown slower than the overall digital ad market in recent years. In our pre-pandemic forecast, we had projected that auto digital ad spend would reach $18.15 billion in 2020 and that it would grow slower than the overall digital ad market (14.1% versus 17.0%). We now forecast that automotive will lag even farther behind the overall industry average in digital ad spending this year (-18.2% versus 1.7%).

Given that demand for automobiles will remain pent up into next year, we expect automotive digital ad spending to rebound by 21.4% in 2021, slightly higher than overall digital ad spending growth, which will be 21.1%.

In 2020, auto will account for 8.1% of total US digital ad spending. With auto advertisers outright reducing their spend—and with strong investments by telecom, computing products and consumer electronics, and other industries—automotive will lose its place among the top five digital ad spenders this year and rank as the sixth-largest spender out of the 10 industries we track. In 2021, automotive will retain its 8.1% share of total US digital ad spending.

Automotive’s reduction in digital ad spend comes down to the massive, pandemic-driven slump in car sales in the US. According to automotive research firm Edmunds.com, auto sales in the US hit a 30-year low in April 2020, down 53% from the year prior.

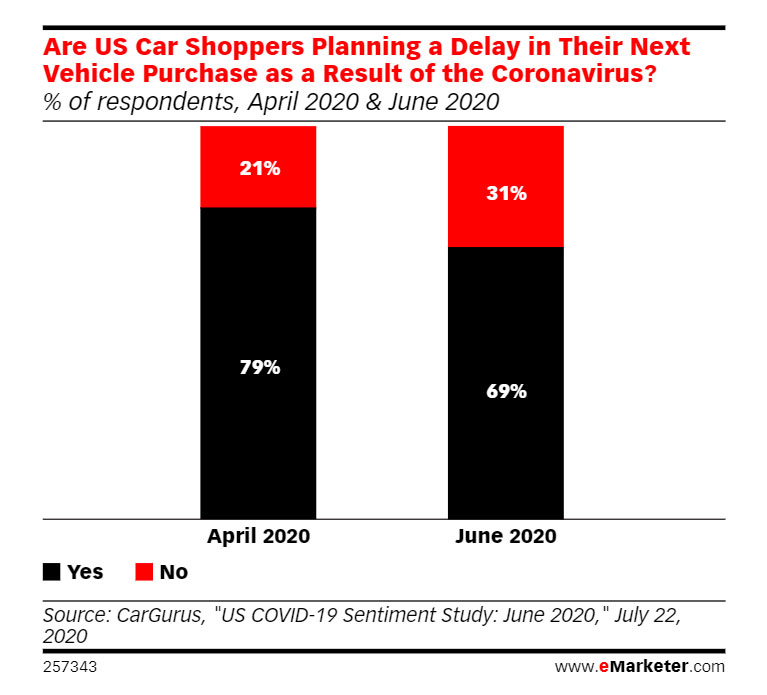

The reasons behind this slump are twofold: Customers have been either unable or unwilling to visit car dealerships, and many would-be car shoppers have delayed making big purchases in these uncertain economic times.

According to a survey conducted in April and June 2020 by auto marketplace CarGurus, 79% of US car shoppers said in April that they planned to delay their next vehicle purchase because of the coronavirus. By June, concerns appeared to have eased only slightly, with 69% of respondents still reporting plans to delay their vehicle purchase.

In mid-March, much of the auto industry began shutting down its manufacturing plants in North America, and operations were stalled until mid-May, when production resumed at limited capacity. This created a shortage of factory-new automobiles at dealerships.

Low supply and low demand prompted advertisers in all three tiers of the automotive industry to severely limit spend. These tiers are automakers and original equipment manufacturers (Tier 1), regional dealer associations (Tier 2), and dealers (Tier 3).

“A lot of the assembly plants were either closed or converted to make medical products like shields and ventilators, so the [new car model] launches and the advertising around them were paused,” said Jon Schulz, CMO of ad tech company Viant Technology. “In Tier 3 you also saw major pullbacks, primarily because dealerships were closed in most states.”

Another blow to the auto industry was the cancellation of live sports. Traditionally, car advertisers invest heavily in linear TV advertising against major sports programming. Some car advertisers pulled a portion of these dollars and planned to reinvest them later in the year. Others reallocated part of their linear TV ad spend to digital but were cautious about spending while dealerships remained closed.

“Auto advertisers rely on linear TV for broad reach, specifically in sports,” said James Malins, general manager of cross-channel strategic solutions at ad platform Amobee. “They looked to reallocate those dollars into formats like connected TV, but with a much more tempered approach.”

The proliferation of digital auto marketplaces like Vroom, Carvana, and Shift in recent years, too, will likely funnel more ad dollars from traditional to digital over time.

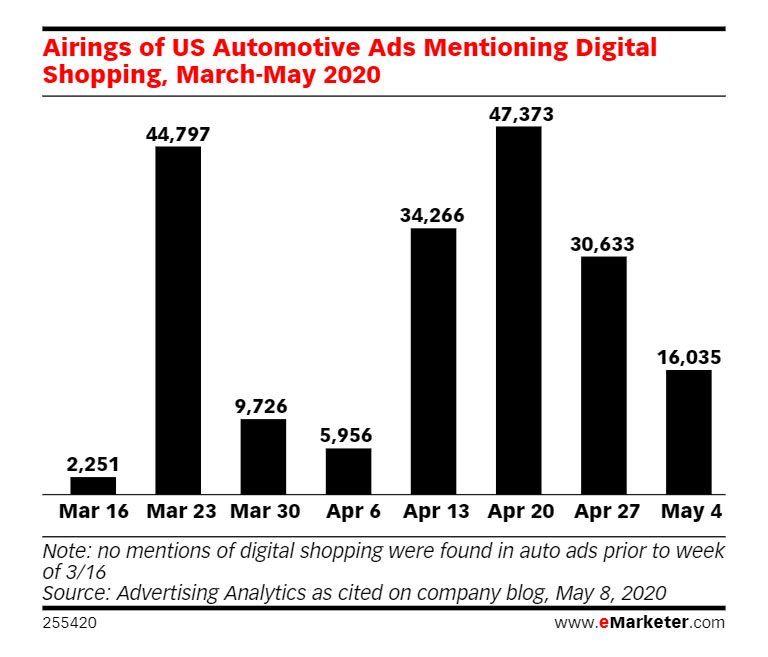

For the TV ads that have run during the pandemic, most auto advertisers focused on brand marketing, with some taking the well-worn “We’re here for you” approach. But there was also a new push by auto manufacturers and dealerships to raise awareness around digital buying. Nearly 45,000 of the automotive TV ads aired in the US during the week of March 23 mentioned digital shopping, according to data from ad-tracking firm Advertising Analytics.

Despite 2020 shaping up to be a grim year for automotive overall, there are glimmers of hope on the horizon. Used car sales rebounded quickly in June, as Americans sought out alternatives to public transportation and vacationed within driving distance in order to avoid air travel. Digital auto marketplaces are enjoying the spotlight as they satisfy this demand. As the pandemic subsides and economic conditions stabilize, car shoppers who have delayed their purchases are expected to return to dealerships. Leases that expired, and were subsequently extended, during Q2 will presumably bring in more customers later in the year and into 2021. And auto advertisers will likely take some of the budget they’d cut in response to the cancellation of live sports and reinvest it in Q4 to raise awareness around 2021 models.

“Automotive is definitely an industry where there’s going to be a refocused energy behind advertising in the coming months,” said Mike Menkes, senior vice president at research firm Analytic Partners. “New models are entering the marketplace, and it’s crucial for brands to communicate when new products are launched in order to drive that awareness and consideration.”

Digital Ad Spending by Device

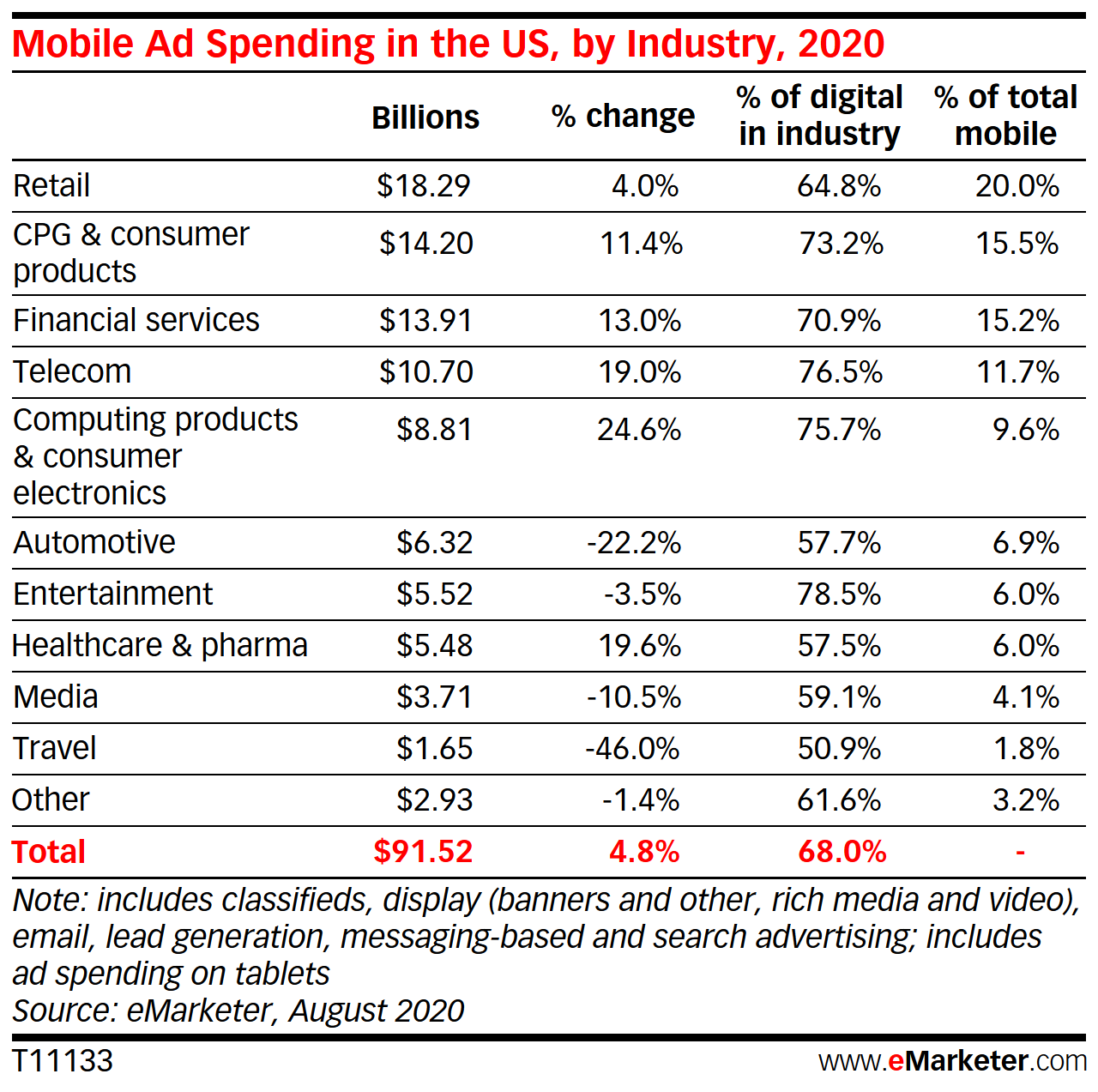

Digital ad spending in the automotive industry skews toward mobile devices. Yet, compared with the total industry average, automotive has spent a smaller portion of its digital ad spend on mobile since we began tracking the vertical. We expect the US auto industry will dedicate $6.32 billion to mobile advertising in 2020, or 57.7% of its digital ad spending. Meanwhile, 68.0% of all US digital ad dollars will go toward mobile.

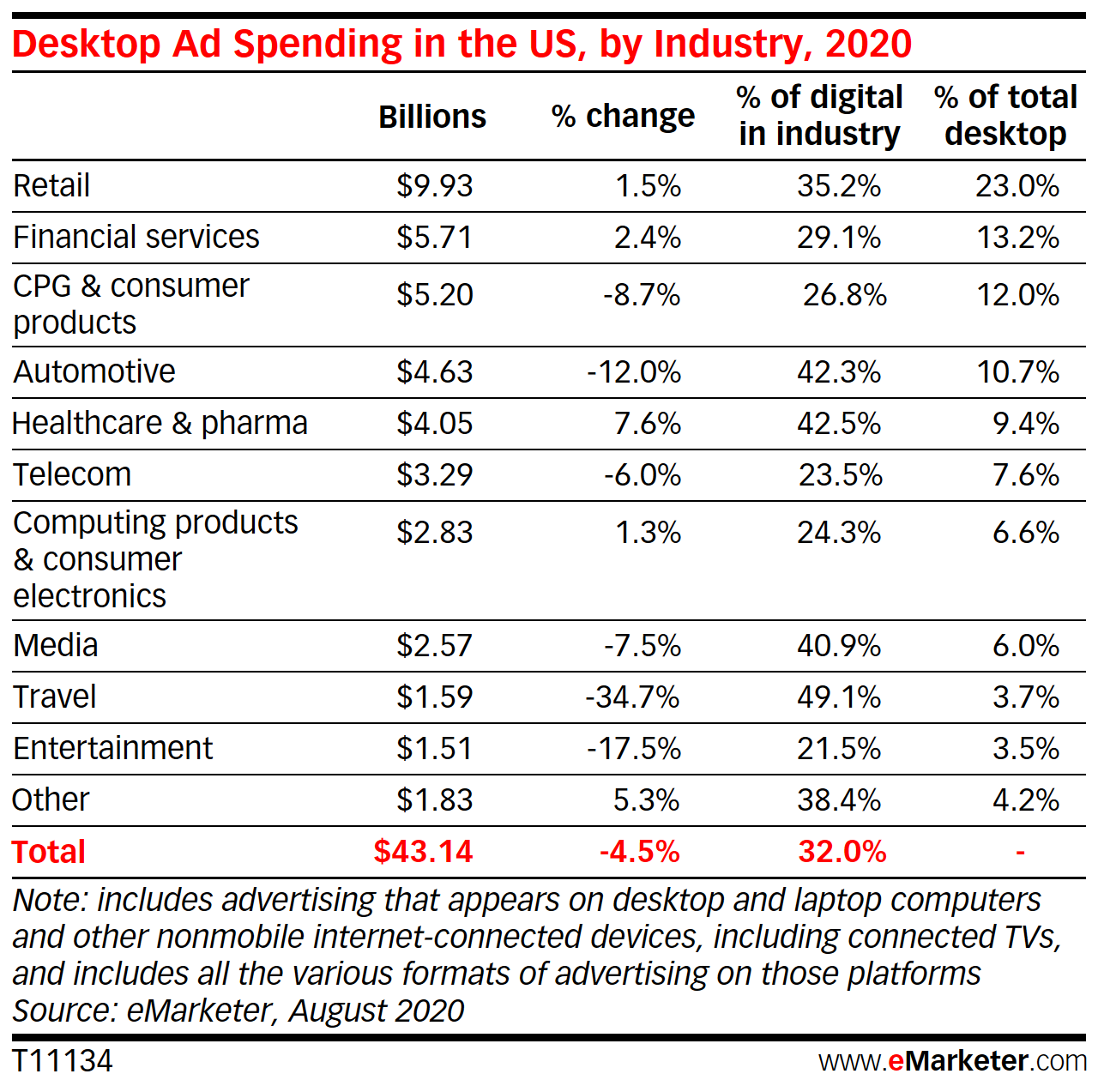

Mobile will bear the brunt of automotive’s reduction in digital ad spend this year, with mobile spend falling 22.2% year over year. By comparison, the auto industry will cut desktop/laptop ad spending by 12.0% in 2020, down to $4.63 billion.

Automotive advertisers have traditionally spent a larger share of their digital budgets on desktop/laptop than the total industry average. Major purchases like vehicles generally involve a fair amount of research, which consumers typically conduct on larger screens.

In 2020, desktop/laptop will claim a 42.3% share of automotive digital ad budgets, whereas 32.0% of total US digital ad spending will go toward desktop/laptop.

The car buying process is shifting toward mobile, however, and ad dollars are likely to follow. In H1 2020, an average of 6.6 million US car shoppers per month did so on a mobile device, compared with an average of 3.4 million who did so on a desktop each month, according to data from Comscore.

Auto advertisers are also funneling linear TV dollars into connected TV (CTV), which we consider a subset of desktop/laptop. This has helped to mitigate, somewhat, the sharpness of the industry’s reduction in digital ad spending. Nonetheless, mobile ad dollars will still outnumber desktop/laptop ad dollars in the auto industry next year. While automotive’s mobile ad spend should grow by 24.8% in 2021 to $7.88 billion, its desktop/laptop ad spend will grow by only 16.8% to $5.40 billion.

Digital Ad Spending by Format

In recent years, the auto industry has distributed its digital ad dollars relatively evenly across search, nonvideo display, and video advertising. Given that automotive advertisers call on a mix of brand and performance marketing, each format plays a part in the overall digital strategy.

“Video historically complements TV ads, then display and search work heavily toward driving car quotes and finding dealers,” Amobee’s Malins said. “It’s a pretty even split, with display and search for direct-response and video for the branding pieces.”

In 2019, automotive digital ad spending skewed toward search, which made up 35.6% of the industry’s digital ad budgets. Video, which we consider a subset of display, claimed 27.5% of auto digital ad spend, and nonvideo display claimed 32.1%. But this year, search will take a back seat, with automakers focusing more on branding and less on performance as a result of the pandemic. In 2020, nonvideo display ads will account for the largest share of automotive digital budgets (33.7%), followed by video ads (31.9%) and search ads (29.1%).

Display and Video

We expect the automotive industry will spend $7.18 billion on display ads this year, down 10.0% from 2019. Display’s share of automotive digital ad budgets will grow, however, to 65.6% in 2020, up from 59.7% in 2019.

Video will be the format least affected by the industry’s reduction in digital ad spend this year. Down by just 5.0% from 2019, video ad spend will contract to $3.49 billion. Even so, video has captured an increasing percentage of automotive digital ad spend in recent years, and 2020 is no exception. This year, automotive’s video ad spend will make up 48.6% of its total display spend. That figure will reach 50.1% by 2021, when auto advertisers will spend slightly more on video than on nonvideo display.

Like many industries that rely heavily on linear TV ads, automotive uses digital video to reach cord-cutters and to gain incremental reach. Because digital video ads are more targetable, they’re also more cost-effective than their linear counterparts, which cast a wider net.

“With any linear buy, your first 50% is efficient, but you have to spend a lot more in order get one new person versus showing 10 ads to the same person again,” Malins said. “These mass advertisers are realizing there’s a tipping point where buying that incremental reach actually becomes cheaper on digital.”

Search

Out of all digital ad formats, search will suffer the most drastic cuts in automotive ad spend this year. We expect automotive search spend will decrease by 32.9% in 2020 to $3.19 billion.

Search advertising still plays a role for automotive, but auto advertisers have devoted less and less of their digital budgets to it over the past few years. Search’s share of auto digital ad spend has declined from 38.2% in 2017, to 37.3% in 2018, to 35.6% in 2019. The sharpest decline will occur in 2020, when that share will sink to 29.1%. In 2021, that figure will sink further, to 28.7%.

That this downward trend began well before 2020 means the industry’s investment in the format won’t rebound as strongly as its display spend next year. We expect automotive’s spending on search will increase by 19.6% in 2021 to $3.81 billion, while its display spend will grow by 22.9%.

Key Takeaways

- Digital ad spending in the automotive industry will contract by 18.2% in 2020 to $10.94 billion. This makes automotive the hardest-hit industry after travel, whose digital ad spend will shrink by 41.0% this year.

- Car sales plummeted during the onset of the pandemic, as dealerships and manufacturing plants closed temporarily. However, pent-up demand for automobiles will allow digital ad spending to recover in 2021, growing 21.4% to $13.29 billion.

- Mobile will capture a larger share of the industry’s digital ad dollars, but this share will be lower than the industry average. We forecast that the automotive industry will spend $6.32 billion on mobile advertising in 2020, or 57.7% of its total digital ad spending.

- Desktop ads remain important, as research for major purchases is often conducted on larger screens. We expect the automotive industry will cut desktop/laptop ad spending by 12.0% this year, down to $4.63 billion. Nonetheless, desktop/laptop will make up 42.3% of automotive’s digital ad spend, above the industry average of 32.0%. Included in desktop/laptop advertising are CTV ads, where automotive reallocated some of its linear TV budget amid the pandemic.

- Auto usually splits its digital ad spend evenly across formats, but search will take a back seat this year. During the pandemic, auto advertisers are focusing on brand marketing over performance. This will cause search ad spending to decrease by 32.9%, while display ad spend will drop by 10.0% and video ad spend by 5.0%.

- The automotive industry will be the sixth-biggest spender on digital ads in the US this year. In 2019, automotive was the fourth-biggest spender, but the telecom industry and the computing products and consumer electronics industry will pass it in 2020.